Resilience is the result of many factors

Companies of all sizes and sectors agree there's more to resilience than a strong balance sheet.

33%

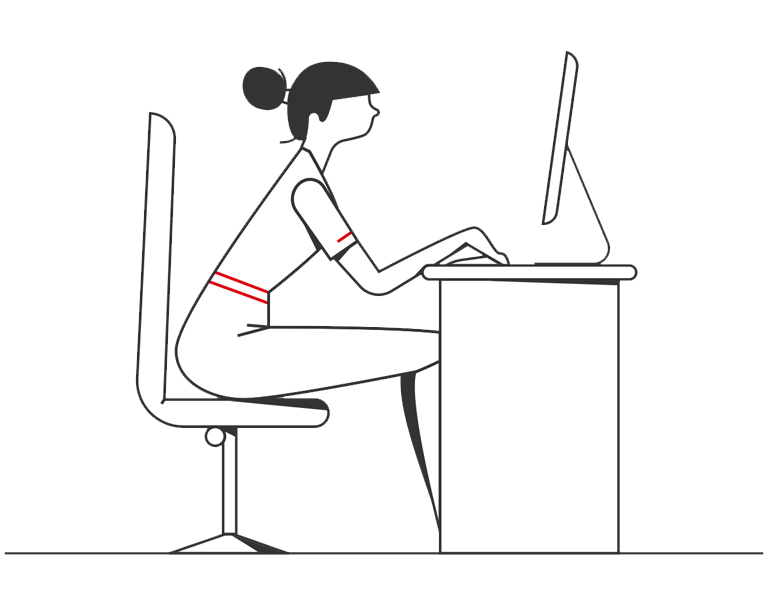

of your peers see employee morale as the biggest barrier to resilience in the next six months

What drives resilience?

What will be the biggest barriers to resilience in the next six months?

Businesses are concentrating on culture

Capturing the positive changes from the crisis and putting people first will help businesses become more agile.

49%

Treating employees well is among the key characteristics of a resilient business

4 in 5

businesses have become closer to their employees, customers and suppliers

How do your peers expect technology to change the way they work in the next two years?

57%

More virtual internal and external meetings

37%

Remote working becoming the norm

27%

Operating out of multiple locations

Technology will continue to be critical

While technology has kept many businesses going, its longer-term value will lie in supporting a more responsive, collaborative culture.

63%

of businesses are preparing for future uncertainty by adopting technology or investing in innovation

Companies prioritise technologies that will enable them achieve their future goals

25%

Tools that enable collaboration through virtual meetings

23%

Tools that enable digitised production processes

9%

Tools that enable digital payments

9%

Tools that enable cyber security

The COVID-19 pandemic has forced businesses into an unprecedented crisis, however amongst the hardship it has become increasingly apparent that technology is the ultimate solution to help businesses - and entire economies - survive periods of extended social distancing. Those companies that have invested and built their strategies around digitalization are the ones most set up to navigate the real-time challenges, to adapt and prosper in today's dramatically reshaped world. We are seeing companies in Vietnam harnessing the power of technologies to respond at pace.

TIM EVANS | CEO OF HSBC VIETNAM

Sustainability is taking centre stage

Businesses increasingly view sustainability as integral to their operations. Like technology, it both builds resilience and offers long-term opportunities for growth.

85%

of businesses see environmental sustainability as a priority

9 in 10

see transformation as an opportunity to prioritise sustainability

Where will the pressure come from to be more sustainable in the next 1-2 years?

92%

External sources, including customers and investors

75%

Internal sources, including employees and business leaders

54%

Regulators, including from industry and government

Closer working will make supply chains more secure

Businesses are using closer relationships with suppliers to gain more control and build transparency.

93%

of companies have supported the businesses they work with

67%

want to make their supply chain more secure over the next 1-2 years

How can you prioritise supply chain security? Your peers are:

31%

Identifying and securing critical suppliers

30%

Reviewing the suppliers' ability to withstand future uncertainty

26%

Working with markets/countries that are more stable

22%

Owning more of the supply chain (vertical integration)

In Vietnam, the EVFTA ratified in June 2020 placed increased importance on businesses redesigning their supply chains to meet the EU's requirements and take full advantage of the opportunities the trade deal offers. At the same time, COVID-19 has served as a warning signal for many to diversify their supply chains to protect from concentration risk on one specific market. A trend we are seeing is businesses closely monitoring their supply chains to ensure their operations are more resilient and less susceptible to disruption from external shocks.

TIM EVANS | CEO OF HSBC VIETNAM