- Article

- Market & Regulatory Insights

- Emerging trends

- Navigator insights

- Industry/sector insights

HSBC Global Trade Pulse Survey

Global businesses brace for supply chain headwinds but optimism about international trade endures

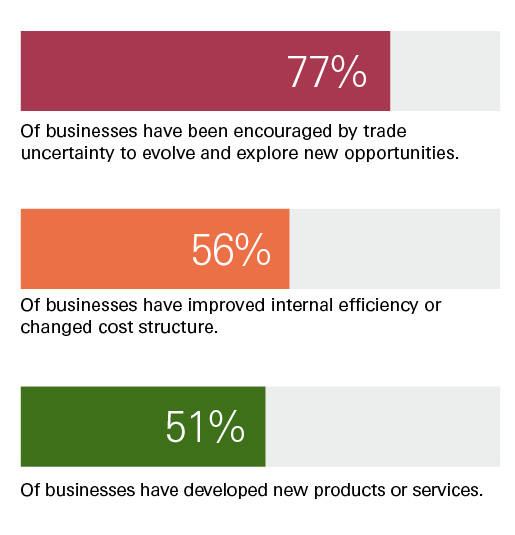

Global businesses are facing surging costs and supply chain disruptions, prompting a strategic rethink of operations and planned investments as tariffs and shifting trade policies continue to take effect.

This is according to the findings of our recent Global Trade Pulse Survey, which offers insight into the business plans and sentiment of over 5,700 international firms across 13 markets regarding tariffs and trade. The survey reveals that two thirds of corporates have already experienced cost increases due to tariff and trade uncertainty – and the worst may be yet to come.

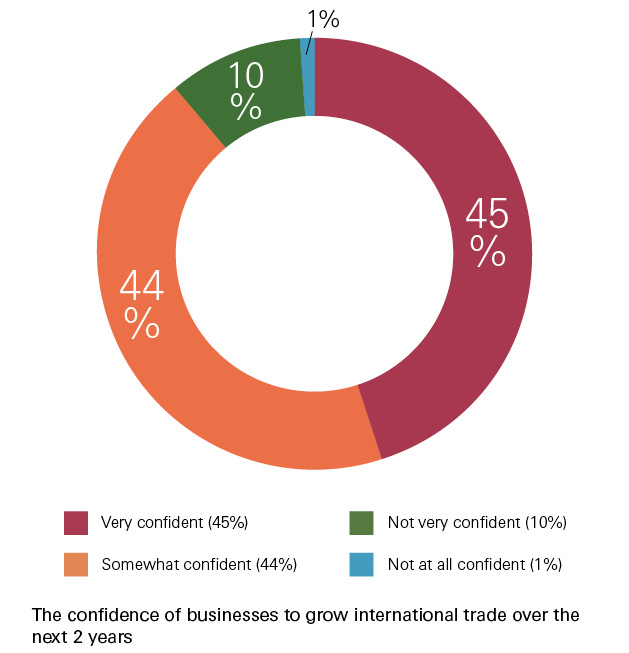

But despite ongoing cost pressures and widespread changes to supply chain strategies, businesses remain overwhelmingly confident in their long-term growth aspects – nearly 90% globally believe they will be able to grow internationally over the next two years. Download the report to learn more.

With over 70% of companies anticipating sustained cost increases, and businesses facing an average 18% drop in revenue, the imperative for strategic adaptation is clear. Navigating this climate requires not only agility, but strong partnerships to ensure sustained growth in a shifting global economy.

Bangladeshi firms expect milder cost pressures from global tariffs

Bangladeshi businesses have, thus far, experienced lower-than-average cost increases from tariffs and anticipate milder cost escalations in both the short and long term, according to our 2025 Global Trade Pulse Survey.

The survey, which gathered insights from over 5,700 international firms across 13 markets, including 250 companies in Bangladesh, found that Bangladeshi businesses are comparatively less impacted by tariff-related cost increases and expect this trend to continue in the foreseeable future.

However, the average expected revenue impact due to supply chain disruptions in Bangladesh is five percentage points higher than the global average.

In response to escalating trade challenges, local firms have implemented proactive measures such as enhancing data analytics capabilities, developing risk management frameworks, diversifying supply chains, and conducting scenario-based simulations. Many are also reorienting their trade strategies toward Europe, the USA, and South Asia.

Key takeaways for businesses in Bangladesh

- 95% of Bangladeshi businesses have already adapted their trade strategies in response to global shifts

- 56% of businesses have experienced increased costs due to tariffs

- 65% are increasing reliance on suppliers and markets in Europe, the US, and South Asia

- 58% identify the US, UK, and Europe as key export markets

- 50% say they would benefit from more strategic guidance on international expansion

The survey findings highlight the adaptability of the Bangladeshi businesses and their optimism to embrace changes. With our global expertise and strong international network, we are ideally positioned to collaborate with our customers and keep connecting them to opportunities here and from around the world.

Take a closer look at our solutions

Global Trade Solutions

We can help your business by being your global connectors, innovative problem solvers and strategic partners.

TradePay for Import Duties

With HSBC TradePay, eligible US clients can directly settle US import duty obligations through HSBC.