- Bangladesh’s Cash Management Bank

- Best Bank for Cash Management Products

- Best Bank for Cash Management Technology

- Best Bank for Client Service

Solutions for your company's evolving needs

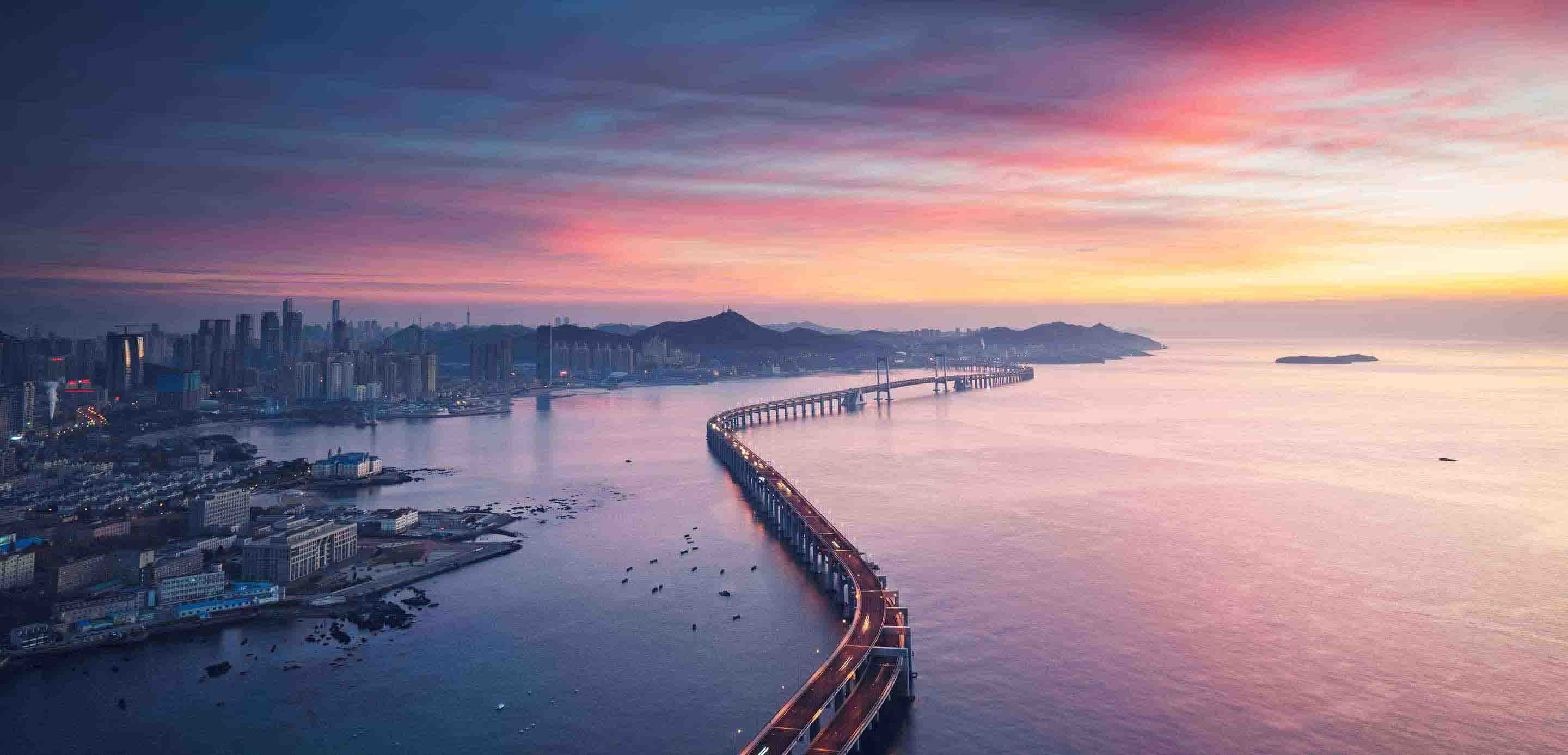

Grow in Bangladesh with confidence

Growing your business internationally opens up to a world of opportunity. We are here to help businesses from Bangladesh and around the world take advantage of that opportunity through our strong network, platforms, knowledge and people. See how we have been supporting our multinational clients to grow in Bangladesh for over 25 years.

Products and Solutions

Browse a selection of products you may be interested in, or search for a specific product by type.

Award-winning banking

Euromoney Cash Management Survey 2025

Euromoney Trade Finance Survey 2025

- Bangladesh’s Best Trade Finance Bank

- Best in Products

- Best in Technology

- Best in Client Service

Euromoney Awards of Excellence 2025

Euromoney Awards of Excellence 2025- Bangladesh’s Best Bank for Sustainable Finance

- Bangladesh’s Best Bank for Large Corporates